“Fashion Rupee: A Loan App or a Trap? Uncovering Fraudulent Tactics”

Are you considering the Fashion Rupee loan app for a quick financial fix? Think twice before diving in. The Fashion Rupees loan application promises to provide users with immediate and convenient access to loans

Fashion Rupee claims to be an actual 7-day loan app tied to a registered NBFC, calling it easy and transparent. But the glossy description fails to match with customer reviews claiming to have seen high interest charges, fraud, and even doctored photographs.

Fashion Rupee is an application that provides access to loans to individuals. It matches individuals with a partner, Jayachelve Financing And Leasing Private Limited, which we are referring to as Jayachelve. Jayachelve is purported to be registered and regulated by the Reserve Bank of India (RBI). This report provides an overview of how the Fashion Rupee application operates, its terms and conditions, features, and what users are commenting on it.

Fashion Rupee is believed to be a new method of accessing instant loans, but the various experiences provided by users question its genuineness. While it appears to be rule-compliant, the negative experiences reported by users tell us something else—a likely exploitation of the borrowers in comparison to what the app assures.

Loan Details

| Loan Amount: ₹5,000 to ₹100,000 |

| Maximum Annual Interest Rate (APR): 22% |

| Handling Fee: Up to 1% of the loan amount + 18% GST |

| Repayment Period: Ranges from 100 to 730 days, although the app is marketed as a “7-day loan app”. |

Loan Calculation Example

To know how much loans will be when using the Fashion Rupee app, take a 180-day loan of ₹20,000 at a 20% APR:

| Handling Fee: ₹200 (1% of ₹20,000) |

| GST on Handling Fee: ₹36 (18% of ₹200) |

| Interest Calculation: ₹1,972.6 (₹20,000 × 20% × 180/365) |

| Total Cost of Loan: ₹2,208.6 (₹200 + ₹36 + ₹1,972.6) |

| Total Repayment Amount: ₹22,208.6 (₹20,000 + ₹2,208.6) |

| Monthly Repayment Amount: ₹3,701.4 (₹22,208.6 ÷ 6) |

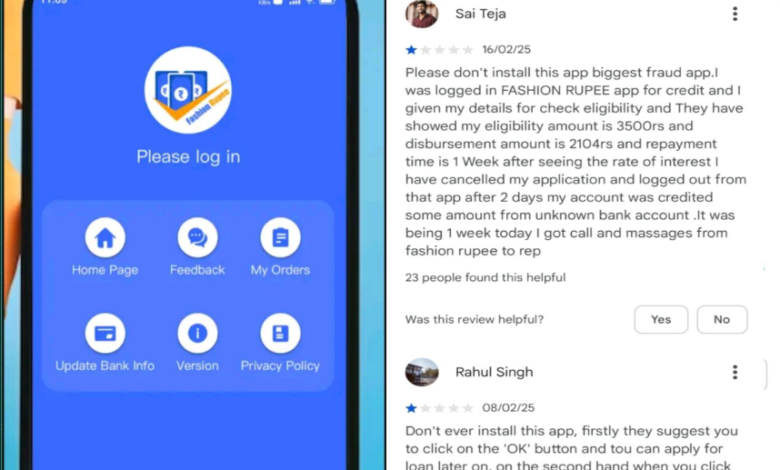

Fashion Rupee received a lot of negative reaction. On the site, there are reviews that indicate there are huge issues as to whether the app is real or not. The following are two extremely concerning reviews:

These incidents reveal significant warning signs that are quite different from those Fashion Rupee asserts. Reports of sudden loans, extortionate repayment requests, and potential blackmail over photo manipulation indicate risky conduct.

Challenging Claims and User Complaints

The app has numerous advantages, but there are misleading aspects when it comes to the loan term. It presents itself as a “7-day loan app,” but it also provides loans that range from 100 to 730 days. This contradiction has left users and prospective borrowers confused.

Beyond the Loan: The Psychological Toll of Harassment

The Fashion Rupee personal loan app has become a source of trouble for borrowers. Within a week of getting loans, users say they face serious harassment, like having their personal information shared and edited pornographic images made. Shockingly, the app’s agents call borrowers’ family members with abusive messages, making things worse. Many users cannot find proof of their loan payments in the app, which has caused them financial ruin and sadness. Sadly, there are reports of people taking their own lives because of the extreme harassment and threats, showing that we urgently need rules to stop this dishonest operation.

How to report this app –

Thank you for bringing this to our attention. We take fraud allegations very seriously and are currently investigating the app you have mentioned.

Open the Google Play app.

Go to the app’s detail page.

Tap the three dots in the top right corner of the screen.

Select “Flag as inappropriate.”

Select the reason why you are flagging the app.

Tap “Submit.”

https://support.google.com/googleplay/community-guide/277862690?hl=en

You can it here –

https://support.google.com/googleplay/android-developer/contact/policy_violation_report?sjid=7204878829122138576-EU