Hyderabad Man Loses Rs 3.5 lakh To ‘Digital Arrest’ Fraud, 3 Arrested

Hyderabad man identified only as Nagesh P, 35 has been a recent victim of a fraudulent digital arrest, lost Rs 3.5 lakh which were defrauded off by the scammers and at the same time 3 suspects were taken into custody

Hyderabad:

In a major discovery, the Cybercrime Police of the Hyderabad district have detained three suspects from Guntur district, Andhra Pradesh, in the case of digital arrest fraud, as it was presented in the press note of the Deputy Commissioner of Police, Cyber Crimes. The names of the arrested persons are Thota Srinivasa Rao (59), Lam Jeevankumar (38), and Tammishetty Raghuveer (40). The accused who are above have participated in a very well-crafted scam that was aimed at the Indian audience all over the country.

The police reported that Veeraboina Sai Raj, a resident of Hyderabad, was cheated by the cyber fraud criminals who deceived him into transferring Rs 3,57,998 to their bank accounts. The accused approached Raj with the pretext of being a head constable and informed him about a case that was filed against him in Mumbai. They also mentioned that the money was the last step to their checking and they would refund it quickly.

The money was then transferred to their account and later to the other participants in the scam. The criminals had told Mr. Raj that the amount would be transferred back to his account and they would give him a Police Clearance Certificate within 24 hours. In connection with the matter, the complainant concluded that the gang of telecallers, who helped the group by developing many bank accounts, as per their well-thought-out plan, have been posing as employees and cheating him for the amount of Rs. 3,57,998.

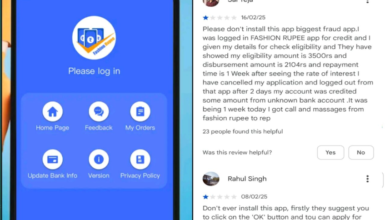

According to the release, the suspects were associated with the crime of cheating by the names of state officers, the victims of which they threatened with false cases as well as arrest. The victims were pressurized to make deposits into the appellants’ accounts to escape from the suspects. They got involved in roughly 13 similar cases all over India.

The Hyderabad Cyber Crime Police have confiscated items like a large number of mobile phones, cheque books, bank passbooks, debit and credit cards, PAN cards, and receipt books from the accused. The police have instructed the public to be very careful if they get calls from unknown numbers, particularly those that are claimed by the caller to be government officials. In addition, they have strongly advised the victims of similar criminals and also to report to the police who are responsible for the case.

At the beginning of March 27, the Hyderabad Police’s Cyber Crime Unit returned the amount of Rs 9,50,531 to the businessman who was cheated by a businessman on an online business fraud. The police informed a 32-year-old businessman from Hyderabad who had been victimized by the cyber criminals who posed as the bank’s agent that they got the money from him by the means of his Rs 9,50,531 transfer to their accounts by telling him that the money was a part of a business deal.

The Cyber Crime Unit of the Police registered a case of Cr. No. of 3083/2024, U/Sec 66(C), 66(D) of the IT Act, and U/Sec 111(2)(b), 318(4), 319(2) of the BNS, and started the investigation immediately. The accused persons including Inspector K Prasada Rao, and SI Abhishek, HC Satish, and PCs Srinivas Reddy and Kranthi Kumar Reddy were tracked down and detained in Sector-7, Dwarka, New Delhi. A check of the defrauded amount was performed which led to the full recovery of the money and the victim was given a demand draft.

The statement reveals that the main concern is that the miscreants are targeting the business community where they are claiming that they can be trusted because they will provide the owners with heavy and good orders. People who were victimized were asked to pay registration fees, process charges, issuance of ISO certificates, developing business websites under the cover of the high market demand. When they would receive the victim’s money, they would cut all ties of communication with them thus making them defrauded.

“Make sure that the authenticity of the information you are considering is verified before any payments are made, and then conduct a comprehensive study of the company or the individuals who are associated with business opportunities,” the publication warned, reminding that it is important to check sources and get confirmation from the government and industry platforms. “Stay away from the kind of business model that requires you to make large prepayments for registration or order processing or something else because legitimate businesses do not incorporate them into their operations,” the statement remarked. “Secure calls and messages and be aware of any kind of attempts to make money by means of scams,” it continued.